Sbi Saving Account Interest

Get details on SBI saving interest rates. Enjoy convenience of banking from anywhere and anytime with a SBI Savings Bank account. You can access your account 24×7 through Tele Banking and Mobile Banking.

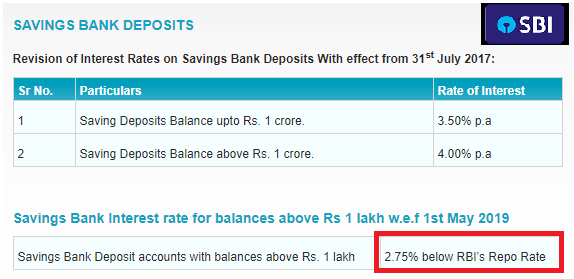

SBI Interest Rates on Savings Account State Bank of India is one of the most reputed banks which provides you an interest rate of 3.5% on cash below Rs 1 lakh and an interest rate of 4% on cash above Rs 1lakh. SBI Savings Account India. Learn more about the types of State Bank of India Savings account ranging from premium to basic.Check interest rates, eligibility &apply online at PaisaBazaar.com. Jan 28, 2021 Interest on SBI Savings account is taxable under the head ‘Income from Other Sources’. Depositors have to show the same while filing their income tax returns. However, an individual and a HUF can claim a deduction up to INR 10,000 on the interest income. The deduction can be claimed under Section 80TTA of the Income Tax Act, 1961. The rate of interest offered for the SBI Savings Plus Account is similar to the SBI Savings Account. Furthermore, the deposit period for the SBI Savings Plus Account is 1 year to 5 years. Customers can also avail the Multi Option Deposit option. On balance above Rs 1 lakh in SBI savings account, the interest rate is linked to the RBI’s repo rate. Presently, it is 2.75 per cent below RBI’s Repo Rate, with a minimum of 2.75 per cent for.

Table of Contents

- 2 Types of SBI Savings Account

SBI Interest Rate on Savings Bank Deposits

| Particulars | Interest Rate |

| Savings Deposits Balance upto Rs. 1 crore | 3.50% p.a. |

| Savings Deposits Balance above Rs. 1 crore | 4.00% p.a. |

Types of SBI Savings Account

Savings Plus Account is a Savings Bank Account linked to MODS, wherein surplus fund above a threshold limit from the Savings Bank Account is transferred automatically to Term Deposits opened in multiples of Rs. 1000.Features of Saving Plus Account

| Eligibility | Any individual eligible to open saving bank account |

| Monthly Average Balance (MAB) Requirement (As per location) |

|

| Mode of Operation | Singly, jointly, or with Either or Survivor, Former or Survivor, Anyone or Survivor, etc. Facility. |

| Rate of Interest | As applicable to Savings Bank Accounts. |

| Minimum threshold limit for transfer to MOD | Rs 35,000/- |

| Minimum amount of transfer to MOD | Rs 10,000/- in multiples of Rs 1,000/- at one instance. |

| Choice of break open of TDRs | The customer has to specify whether’ First in First Out” or “Last in First out” principle should be applied for break opening of deposits. In absence of any mandate the “last in First out” principle will be applied. |

| Period of deposit | 1-5 Years |

| Facilities offered | All facilities offered to savings bank account holders such as ATM card, mobile banking, Inter Net banking, SMS alerts are available in this account. |

| Loan against MOD deposits | Available |

| Most Important Terms & Conditions | Savings Bank linked to Multi Option Deposit (MOD) account, for auto sweep, for issue of Term Deposits and unitized break-up facilities. Any surplus funds retaining a minimum of Rs. 25000/ in Savings Bank (to be set up by the customer) will be transferred as Term Deposit with a minimum of Rs. 10,000/- and in multiple of Rs. 1,000/- at one instance. |

Eligibility For Basic Saving Bank deposit Account

| Eligibility | As applicable to regular Savings Bank Account |

| KYC requirement | The account will be KYC compliant. |

| Mode of Operation | Singly, jointly, or with Either or Survivor, Former or Survivor, anyone or Survivor etc. Facility. |

| Available at | All branches |

| Minimum balance amount | Nil |

| Maximum balance /amount | No upper limit |

| Rate of Interest | As applicable to Savings Bank Accounts |

| Operations in the Account |

|

| Service Charges |

|

| Most Important Terms & Conditions |

|

Features of SBI Small Account

Eligibility As applicable to regular Savings Bank Account| KYC requirement | Liberalized (Submission of self-attested photograph and affixation of signature or thumb impression before the officer of the Bank who is authorized to approve opening of accounts). |

| Mode of Operation | Singly, jointly, or with Either or Survivor, Former or Survivor, anyone or Survivor etc facility. |

| Available at | All branches except specialized branches e.g. Personal Banking Branches (PBBs)/ Special Personalize Banking (SPB)/ Mid Corporate Group (MCG)/ Corporate Account Group (CAG) branches. |

| Minimum balance amount | Nil |

| Maximum balance /amount | Rs. 50,000/- |

| Rate of Interest | As applicable to Savings Bank Accounts. |

| Operations in the Account | Using withdrawal form or through ATM. Basic RuPay ATM-cum-debit card will be issued. |

| Service Charges |

|

| Most Important Terms & Conditions |

|

Both the Savings Accounts are fully loaded; replete with banking features like Internet Banking, Mobile Banking, etc. which will not just acquaint children with the different channels of modern-day banking but also teach them the nuances of personal finance. All these features come with 'per day limits' to ensure that they spend the money wisely.

Features of Saving Accounts For Minors

| Features | PehlaKadam | PehliUdaan |

| Eligibility | Minor of any age. This account will be jointly opened with the parent/guardian. | Minors above the age of 10 years and who can sign uniformly. This account will be opened in the sole name of the minor. |

| Monthly Average Balance (MAB) requirement (As per loaction) |

| |

| Maximum Balance | Rs. 10 lac in the Account | |

| Mode of Operation | Jointly with the Parent/ Guardian or Singly by Parent/ Guardian | |

| Internet Banking | With Enquiry rights and limited transactions like - Bill payment, Opening e-Term Deposit (e-TDR)/ e-Special Term Deposit (e-STDR)/ e-Recurring Deposit (e-RD), Inter-Bank funds transfer (NEFT only), and Issue Demand Draft. Per day transaction limit of Rs. 5,000/- | With Enquiry rights and limited transactions like - Bill payment, Opening e-Term Deposit (e-TDR)/ e-Special Term Deposit (e-STDR)/ e-Recurring Deposit (e-RD), Inter-Bank funds transfer (NEFT only), and Issue Demand Draft. Per day transaction limit of Rs. 5,000/- |

| KYC Requirements |

| Date of Birth proof of the Minor Aadhaar and PAN or Form 60. Where Aadhaar number has not been assigned to an applicant, the applicant shall furnish proof of application of enrolment for Aadhaar and in case PAN is not submitted, one certified copy of an Officially Valid Document (OVD) along with Form 60 is required. In case the applicant is not a resident or is a resident in the states of Jammu and Kashmir, Assam or Meghalaya and does not submit the PAN, he shall submit one certified copy of OVD containing details of his identity and address and one recent photograph. |

| Cheque book | Cheque-books are available where Mobile No. Of the account holder is recorded. Specially designed Personalised chequebook (with 10 cheque leaves) will be issued to the Guardian in the name of minor under guardian. | Cheque-books are available where Mobile No. Of the account holder is recorded. Specially designed Personalised chequebook (with 10 cheque leaves) will be issued if the minor can sign uniformly. |

| Photo ATM-cum-Debit Card | Child's photo embossed ATM-cum-Debit Card with withdrawal/POS limit of Rs. 5,000/-. Card will be issued in the name of the minor and Guardian. | Photo embossed ATM-cum-Debit with withdrawal/POS limit of Rs. 5,000/- will be issued in the name of the minor. |

| Mobile Banking | With viewing rights and limited transaction right like: Bill payment, Top ups. Per day transaction limit of Rs. 2,000/- | With viewing rights and limited transaction right like - Bill payment, Top ups, IMPS. Per day transaction limit of Rs. 2,000/- |

| Auto sweep | Auto sweep facility with a minimum threshold of Rs. 20,000/-. Sweep in multiple of Rs 1,000/- with a minimum of Rs. 10,000/- | |

| Over Draft for Parents/Guardians | Overdraft against Fixed deposits for parent/guardian subject to fulfilling other terms and conditions. | No overdraft facility under this product |

| Standing Instruction | An option of setting up of one Standing Instruction for Recurring Deposit, free of charge. | |

| Other Features |

| |

| PAI for Parent (Optional) | Personal Accident Insurance Cover (offered by SBI General) for the Parent (in case of Pehla Kadam account only). | |

| Child Plan (Optional) | Smart Scholar (Market Linked) - Child Plan offered by SBI Life with inbuilt premium waiver benefit and loyalty additions to fulfil the child's dreams. | |

SBI Digital Saving Account Details

Eligibility for SBI Digital Savings account- Only Resident India Individual, over 18 years of age with capacity to contract in accordance with applicable laws in India, without any tax liability outside India is eligible for opening SBI Digital Savings Account.

- Customer must be having a valid Aadhaar number and valid Permanent Account Number. In case Customer’s name as reflected in Aadhaar is different from that as reflected on the PAN Card, the details as per Aadhaar will be taken on record.

- Customer must be having a valid and active local mobile number registered in his/her name, a smart phone, and a valid and active email address.

- Customer will have to successfully complete e-KYC through biometric authentication through SBI branch and have to comply with all other requirements including KYC requirements as may be specified by the bank for Digital savings bank account.

- Only one Digital Savings Account can be opened from one Mobile Phone/Device.

- At any given point of time, Customer can have only one SBI Digital Savings Account.

- Customer must download the YONO by SBI APP on his/her Mobile Phone/Device.

- SBI reserves the right to reject request for SBI Digital Savings Account without assigning any reason.

| Single Operations | An individual who fulfils the eligibility criteria mentioned above can open and operate SBI Digital Savings account in his/her own name. Joint account or joint mandate for operation of SBI Digital Savings is not permitted. |

| Only One Account per Individual | Each eligible individual can only open one SBI Digital Savings Account. |

| Minimum Balance | Customer will be required to maintain minimum balance as defined for normal Savings Bank Account. |

| Service Charges | There will be 25% concession on service charges related to Digital Savings Account; for accounts having quarterly average balance Rs 25,000/- and above. |

| Conversion of Account | Account holder will have the option to convert the Digital Savings account to joint account only after converting it to a regular savings account by visiting the home branch. The customer will be allowed to convert the Digital Savings Account to Regular Savings Account or as a CSP Account (except Basic Savings Deposit account and Pehla Kadam Pehli Udaan account). |

| Cheque Book | No free Cheque book/leaves will be provided for Digital Savings Account. However, Customer will have an option to opt for cheque book facility any time. For Cheque facility bank will charge @ Rs. 10/- per Cheque leaf; and minimum 10 Cheque leaves will be issued per request. |

| ATM Cum Debit card | A personalized special Platinum Debit Card (with customer’s photo when account is activated at sbiINTOUCH branch), will be issued free of cost. Annual maintenance charges of Rs. 200/- p.a. will not be charged from the second year for the card where customer maintains Average Quarterly Balance above Rs. 25,000/-. ATM pin has to be generated through Green PIN process. |

| Passbook Book | Passbook will not be provided in the account. Customer will be sent an audio-visual statement by email. |

| Statements of Account | A monthly Electronic Statement will be available on the Yono by SBI App as per the Bank's record. Monthly statements of account for the last 2 years will be available through the Yono by SBI app; however, this duration is subject to discretion of the Bank. |

| Technology Dependent | SBI Digital Savings for selected content is handset/operating system dependent. This Service is currently available on iPhone with iOS 6 and above, Android Phones with Android version 4.2 and above. There will be no obligation on the Bank to support all versions of Mobile Phone software. |

| Home Branch | Branch selected by the applicant will be tagged as Home Branch for opening Digital Savings Account Regular and other loan accounts in future. |

| Nomination Facility | The Nomination Facility is available within the Yono by SBI app and is mandatory for Digital Savings Account. Nomination can be made in favour of only one nominee. |

| Closure of Account by the Customer | The Digital Savings account can be closed only by making a written request at the home branch only. |

| Opening of Fixed Deposit and Recurring Deposit Accounts |

|

Features of SBI Savings Account

| General |

|

| Auto Sweep Facility | Savings Bank account can be linked to Multi Option Deposit (MOD) account for earning higher term deposit interest on surplus money. |

| Special Salary Accounts | SBI offers special Salary Accounts for employees of Corporates, Schools, Colleges, Universities, Government establishments/ organizations, Railways, Police establishments, Defense Personnel etc. |

| Children Accounts | Pehla Kadam and Pehli Udaan, are savings bank accounts specially for children that will not only help them learn the importance of saving money but will also allow them to experiment with the ‘buying power’ of money. |

| ATM-Cum Debit Card | SBI Card comes in multiple variants like Silver, Gold, Platinum Cards, International ATM-cum-Debit Card, etc. as per your eligibility. |

| Mobile Banking | Away from home, balance enquiries can be made and/or money sent to the loved ones or bills can be paid anytime 24×7!!! That is what State Bank FreedoM offers – convenient, simple, secure, anytime and anywhere banking. |

| Internet Banking | www.onlinesbi.com, the Internet banking portal of our bank, enables you to operate your accounts from anywhere anytime, removing the restrictions imposed by geography and time. State Bank Anywhere is the Internet Banking App available for all the major operating systems: Android, Windows, Blackberry and iOS. |

| SBI No Queue | State Bank No queue is a unique App to enable customer to book a Virtual Queue Ticket (e-Token ) for selected services at selected SBI branches |

| Missed Call Banking | With SBI Quick, you can get your Account Balance, Mini Statement and more just by sending an SMS or giving a Missed Call! |

| Rewardz Program | Get rewarded for various transactions that you make! SBI Rewardz allows you to collect points which can be redeemed for full or partial payments to get products & services online as well as from partner outlets. |

| 3 in 1 Demat & Online Trading | With the 3 in 1 Demat and Online Trading account, you would get access to the financial markets through our tie-up with SBI Cap Securities Ltd. Savings bank account will be held with SBI while Demat and Online Trading account will be held in the books of SBI Cap Securities Ltd. |

| Personal Accident & Health Insurance | As a State Bank savings bank account holder, you would get Personal Accident and Health Insurance at discounted rates from SBI General Insurance Company Ltd. |

| Contact Center | Access to our 24×7 multi-lingual Contact Center to get details on our latest offerings, place request for products, services etc. |

SBI Saving Account Bank Rules

Customer Guidelines to SBI Saving Account

- Accounts are required to be opened with Aadhaar number issued by UIDAI and PAN or Form 60 at the time of opening an account as KYC document.

- In case the applicant is not a resident or is a resident in the states of Jammu and Kashmir, Assam or Meghalaya and does not submit the PAN, he shall submit one certified copy of OVD containing details

How To Open An Saving Account

- Duly fill in and sign the prescribed application form.

- Applicant(s) should submit two copies of his/ her/ their recently taken passport size photographs.

- Account holders signatures must be legible and well formed. (sign should not be in capital letters).

- Each account will be given a unique account number.

Sbi Saving Account Interest Rate India

All withdrawals must be in round Rupees only.

Operations In SBI Saving Account

- Savings Bank account is essentially a facility to build up savings and hence must not be used as a Current Account.

- No restriction on number of deposits that can be made into the account.

- No deposit in cash for less than Rs 10/- will be accepted.

- Cheques, drafts or other instruments drawn only in favour of the account holder will be accepted for credit of the account

- Third party instruments endorsed in favour of the account holder will NOT be accepted

- The account holder can withdraw money personally from her/ his ordinary Savings Bank Account by using Banks standard withdrawal form. The pass book must accompany the withdrawal form.

- ATM cum Debit card can also be used in ATMs for cash withdrawal.

- The accountholder cannot withdraw an amount less than Rs. 50/-

- All withdrawals must be in round Rupees only.

Savings account holders with the country’s largest lender State Bank of India (SBI) will now earn an interest of 2.75 percent effective from April 19. With interest rates being slashed twice in two months, it is the lowest ever return offered by any Indian banks for its savings account. Amidst a pandemic, the falling interest rate for savings accounts is becoming a concern, as taking the cue from SBI, other banks might also follow suit.

The trigger for the second cut within a month

Following the Reserve Bank of India (RBI) declaration of 75 basis points repo rate cut as a COVID-19 rescue package last month, SBI announced a 25 basis point cut in its savings account interest rate to 2.75 from existing 3 percent. This was in fact the second interest rate cut for SBI saving accounts. Earlier on March 11, the rates were brought down from 3.25 to 3 percent for savings accounts with the balance above Rs 1 lakh. For this, the bank had explained that it does not need to incentivize customers with the extra rate of interest for deposit inflow as it already has enough liquidity. The real explanation, however, is due to RBI’s liquidity easing measures, banks are forced to cut lending rate, hence they wanted to make up the losses by bringing down the deposit rates.

Savings account interest rate revision in the past

As a part of financial sector reform, the RBI, in 2003, deregulated interest rates on deposits, other than savings accounts. The interest rate for savings deposits (fixed by RBI) between March 2003 and May 2011 remained 3.5. Finally, in 2011, individual banks got the power to determine their saving bank deposit interest rates, under two conditions:

- Each bank will have to offer a uniform interest rate on savings bank deposits up to Rs 1 lakh

- However, for savings bank deposits over Rs 1 lakh, a bank may provide differential rates of interest, if it so chooses

Following this, most major banks have been paying a 4 percent interest rate to its savings account holders.

However, for the first time ever since deregulation, SBI slashed its savings account interest rate to 3.5 percent in July 2017 triggered by demonetization and also falling inflation and real rate recovering.

Falling Savings Account Interest Rates

| Date | Revised rate for SBI savings deposit accounts |

| March 2003 | 3.5% |

| May 2011 | 4% |

| July 2017 | 3.5% |

| March 2020 | 3% for deposits above ₹ 1 lakh |

| April 2020 | 2.75% |

Your cash in the bank account will now give negative inflation-adjusted returns.

With the interest at 2.75% and the annual inflation hovering at around 4%, the real returns you are getting now are actually negative. Forget about it growing, your money is now losing its value sitting in the bank account.

So if you are still keeping any cash apart from what you need for your regular expenses like paying bills etc., you are making a loss. But it doesn’t have to this way.

SmartDeposit as an alternative to a bank account

While we all cannot afford to let go of a savings account, we can make sure all the extra cash we have like an emergency fund or the money we don’t need in the next 7 days is not losing its value. And there is a solution that allows you to do that at almost zero risks.

That solution is ETMONEY SmartDeposit. Here are some key reasons why-

- Low Risk – There is almost negligible risk of you incurring any loss. That’s because you are putting money in a liquid debt fund, which are the safest mutual funds.

- FD-like returns with no lock-in or penalty – While there is no guarantee of returns, SmartDeposit 1-year returns are 6.24%. That’s similar to FD of similar duration will give. Plus there is no lock-in and you don’t pay any penalty if you redeem after 7 days

- Bank Account like liquidity with Instant Redemption – With SmartDeposit, you can get instant access to your money. Just tap and money comes into your account. Be it a holiday or the middle of the night.

Bottom line:

Sbi Saving Account Interest Rate

With banks flush with cash due to government push to infuse liquidity in the system, banks have little or no incentive to pay a higher interest rates to retail investors. Due to this, interest rates are expected to stay low for quite some time. So, move your money to ETMONEY SmartDeposit today. And if you are someone who hasn’t build an emergency fund, it is a good idea to begin now and SmartDeposit is the perfect place due to reasons we mentioned earlier.

Sbi Saving Account Interest

You can download ETMONEY to invest with Smart Deposit, which is the smartest way to invest in liquid funds.